Facebook’s Libra — Cryptocurrency or Big Brother?

Another feather in Zuckerberg’s cap? Or is something else?

Another feather in Zuckerberg’s cap . . . something else?

Is Facebook’s new digital currency, Libra — hubris, or part of Mark Zuckerberg’s plan to take over the world? Or is it a little bit of both.

As of August of 2018, the number of existing cryptocurrencies was over 1600 and growing. As of December of the same year, “crypto’s” had a market capitalization of 100 billion dollars, with bitcoin being the predominant player.

As of March 31, 2019 there are 2.4 billion monthly active users of Facebook. The company continues to grow at a rate of 8% of users, year after year.

If you just look at those two data sets alone, one could see why Zuckerberg wanted to create his own currency.

Libra is similar to bitcoin in that it will use the same blockchain structure.However, Libra will be what is called a “stablecoin”. In other words, it will be pegged to a basket of currencies. But exactly which national currencies are in that basket, and which are out, and how it is all weighted is currently unknown. As of this writing, we know three of the currencies are the US dollar, the Euro and the Yen, and that Libra will have a value of about one US dollar. Keep in mind that even a pegged currency can fluctuate.

What is also known about Libra is that it will be overseen by a new corporation specifically created and headquartered in Geneva. There are currently 28 members of this corporation, Mastercard, Spotify and Uber among them, but it’s open to any company with a value of $1 billion dollars and willing to invest a minimum of $10 million.

In an effort to increase transparency and limit control, Facebook maintains that its voting power will be limited to 1% of this new corporation.

The currency will be available in Facebook’s platforms via an application called Calibra, which will be woven into Facebook Messenger and WhatsApp. Calibra will also be available as a stand alone application.

It appears as though one of the primary markets for Libra is the 1.3 billion people worldwide who are “unbanked” or not served by any financial institution. One central goal of Libra will be to make it easier, and essentially free, to send money globally. On average, the fee to send $200 dollars across borders is 7.1%. With Libra, those unbanked can avoid those high fees.

The idea of creating a digital currency to assist those that are unable, for whatever reason, to access financial institutions sounds very white hat and noble. But, Facebook operates as a capitalistic and profit driven endeavor, which means that it’s not nearly as altruistic as it sounds. Certainly, Libra has all the elements of that “do no evil” vibe that has made more than a few billionaires in Silicon Valley. However, where there’s money, it’s complicated . . . and where there’s Wall Street and banks, well . . .

In many parts of the world, Facebook and its subsidiaries are unable to dip into the pool of advertising cash because the countries are simply poor. Libra would invite the people of those poorer countries to exchange their national currencies which would in turn create new revenue opportunities, and a vast pool of funds, for Facebook and its companies.

For example, look at the countries in Africa. According to a World Bank report from 2014, there are 350 million unbanked adults in Africa, which accounted for 17% of the global total. As of December 2018, Facebook reported that it had 139 million active monthly mobile users in Africa. While Africa remains the poorest continent on the planet, it’s hard to squeeze any ad revenue out of that.

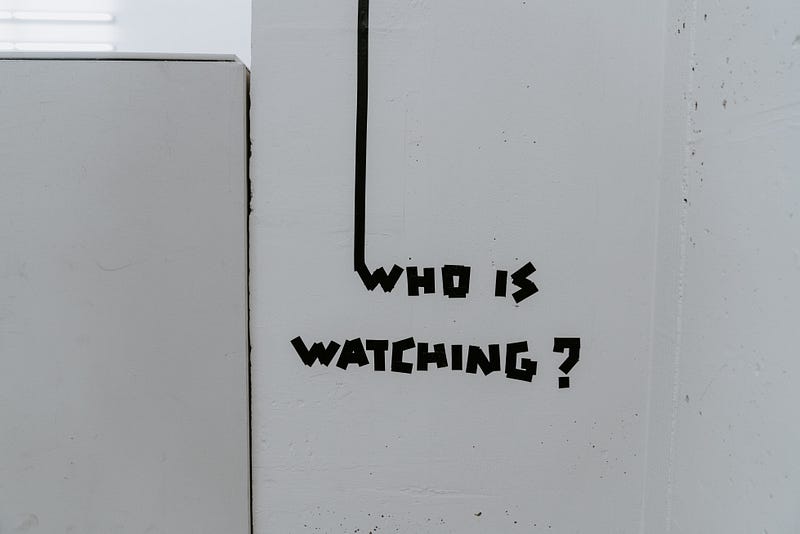

With Libra, Facebook can gather from Africa, and ultimately around the world, that which feeds its engine: data.

The company has spent the past few years defending itself against its data collection and its data breaches. Mark Zuckerberg’s promises to “do better” have rung a little empty and fallen quite short. I’m not convinced that the launch of Libra and the Calibra app is likely to help matters. But the company does claim via its white paper, “Calibra will not share account information or financial data with Facebook, Inc. or any third party without customer consent.”

It’s worth remembering that Facebook has a history of strong arming consent from its users by way of limiting access to its services unless consent is provided.

Now while they claim they “will not share” any data, rest assured Facebook will be collecting it. It might be wise to give pause to a company whose track record with data gathering, and its handling, is suspicious at best.

So make no mistake, Libra will be gathering your data and creating predictive models based on how you use the digital currency. How that plays out in five or ten years is impossible to say, but I do think they mean it when they say they “will not share” any data. But collect? Use in the future? Oh yes, they’re going to use your data because that’s what Facebook does . . . with varying degrees of success.

But beyond money transfers, every day consumerism and data collection, the other part of this is that Zuckerberg has a strong desire, and belief, that all functionality can be done through Facebook. You may recall that there was another company about 25 years ago who thought the same thing, America OnLine.

However, this time there is a business model, albeit a little authoritarian in nature, that actually works for Zuckerberg to model himself after. It’s China’s multi-purpose messaging, social media and mobile payment application WeChat.

It appears as though he’s on to something. According to The Guardian, this idea of using one application to do virtually everything is gaining such rapid acceptance that even stodgy Britain has considered using Facebook logins to allow people to view social security benefits, make tax payments and get a driver’s license.

Of course, there are still many unanswered questions about Libra, like how will it handle money laundering? How will Libra be tied to inflation? How will it impact countries where the currency is already a little dicey? In fact, India’s antagonism towards digital currency has already prevented Libra from launching in that country. For now.

Is it the goal of Mark Zuckerberg and Facebook to take over the world? I don’t believe it is. However, I do believe that his vision is for the world to use Facebook as the primary tool that drives people’s lives. As he’s always maintained, his goal is to get the world connected, “There is a huge need and a huge opportunity to get everyone in the world connected, to give everyone a voice and to help transform society for the future.” Libra is just one more item on his checklist to accomplish this.

At the end of the day, what is Libra? As a financial device, I’m still unclear but a lot of people are. We’ll have to wait a little bit longer until Libra launches in the first half of 2020.

But I know this much, it’s a digital currency developed by Facebook with, what appear to be moderately good intentions and just a hint of that famous Zuckerberg hubris. More than that, I think it’s part of Zuckerberg’s plan to get people more integrated using the Facebook application and creating a world where they come to rely on it for more than just communication. In the process, this is allowing his company to gather more data to develop predictive models on human behavior to market, and exploit, in the future.

Mark Zuckerberg may not want world domination, perhaps he just wants to be the crown prince of surveillance capitalism.

The direction that we’re headed, it’s going to be a thin line between the two.